Hedging techniques assist brokers with moderating dangers and shield exchanging accounts from losses. Find the best Hedging procedures to benefit from forex. 6 May 2010 was an ordinary day for the business sectors. In the UK, occupants were setting off to a political decision while in Wall Street, the main worry among brokers was the Greek obligation emergency. At that point, in the early evening, something strange occurred. Out of nowhere and with no significant news feature, US markets failed with the Dow shedding in excess of 1,000 focuses. This occasion is currently known as the blaze crash.

A comparative decrease on the planet's business sectors occurred in January 2015 when the Swiss National Bank (SNB) unpegged the franc from the dollar. It was an astounding move on the grounds that nobody anticipated it.

Those unforeseen occasions are not normal but rather when they occur, dealers and financial specialists lose billions of dollars. Not at all like other significant occasions, for example, Brexit and worldwide decisions, nobody can anticipate when these occasions will occur. This brings the requirement for appropriate danger the board procedures in expectation for such happenings.

A decent method to limit the danger is through Hedging. Hedging is the act of limiting dangers by opening various Trade and profiting by the spread between the benefit and misfortune. Here are probably the best Hedging procedures you can utilize.

Opening two Trades of a similar security

Opening two trades of a similar image is a protected method of Hedging the dangers on the lookout. For instance, accept that the EUR/USD pair is exchanging at 1.1200. In the wake of doing your investigation, you find that the pair could increase 10 pips and come to the 1.1210. In this way, you choose to get one parcel of the pair, with the take benefit at 1.1210 level. To diminish the dangers, you can choose to sell a large portion of a great deal of the pair. On the off chance that the Trade goes right, your greater purchase Trade will be beneficial, however the more modest sell Trade will make a misfortune. For this situation, your benefit will be the spread between the benefit and loss of the Trade. Then again, if the pair goes down, your greater Trade will make a misfortune, which will be counterbalanced by the benefit on the more modest Trade.

Exchanging the places of refuge

A couple of monetary forms and protections are viewed as places of refuge. The supposition that will be that merchants will in general move to them when dangers increment. The Japanese Yen is viewed as a sanctuary due to the enormous outside depositories the Bank of Japan (BOJ) holds abroad. It is the second biggest holder of US depositories after China. Hence, the yen consistently increases in any event, when North Korea fires rockets above Japan.

The Swiss franc is additionally viewed as an asylum mostly in light of the dependability of the Swiss economy and the strength of the Swiss monetary framework. An investigation by a gathering of business analysts from Bundesbank for the period somewhere in the range of 1986 and 2012 found that the Swiss franc would in general value during times of expanded unpredictability.

Multi-resource relationships

Another approach to support against hazard is to apply the idea of relationships. This idea arises on account of the different connections that exist between various resources. Firmly related resources move similar way while conversely corresponded resources as a rule move the other way.

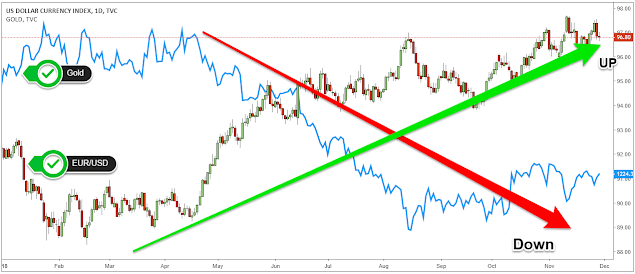

A genuine illustration of truly contrarily connected protections is between the US dollar and gold. Gold is a metal utilized generally for venture purposes and is constantly cited in dollar terms. Hence, when the dollar rises, gold will in general fall and when the dollar falls, gold will in general ascent. Between January 2018 and mid-August of 2018, the dollar file had picked up by over 5% while gold had fallen by over 4%.

Close amazing relationships occur in different protections as well. For instance, due to the nearby relations in raw petroleum flexibly, the cost of Brent – the worldwide benchmark – and West Texas Intermediate (WTI) move in a comparative bearing. In the period above, Brent and WTI had picked up by about 7%.

Money uneven characters make great Hedging open doors for brokers. On account of unrefined petroleum, a bullish dealer can purchase the costly Brent prospects while selling the generally less expensive WTI rough. On the off chance that the cost of oil moves higher, the Brent Trade will be productive while the WTI Trade will move lower. The benefit will thusly be the benefit of the Brent short the deficiency of the WTI.

A similar procedure can be utilized in contrarily corresponded sets like gold and the dollar. A merchant bullish on the dollar can support the Trade by undercutting gold fates.

A simple method of discovering connections between's protections is to fill their end costs in Microsoft Excel and afterward to execute a relationship work.

Trade

Trade is a type of connections exchanging where dealers profit by the connected developments of protections. There are a few kinds of Trade openings utilized by brokers to fence against hazard.

Consolidation Trade is utilized by stocks or CFDs dealers to profit by consolidations and securing (M&A). At the point when an obtaining bargain is reported, the load of the two organizations move in various manners. The load of the organization being procured goes up while that of the getting organization moves higher. In this way, a dealer can purchase the stock or CFD of the organization being gained while at the same time selling that of the procuring organization.

In factual Trade, a broker makes two 'bins' of protections. The main bushel has cash matches that are oversold while the subsequent one has overbought sets. The merchant at that point purchases the sets in the principal bushel and afterward at the same time sells the sets in the subsequent crate. The expectation is that the two bins will turn around and produce a benefit for the broker.

In danger Trade, a broker thinks about at least two business sectors. The most widely recognized strategy is to think about the developing business sectors and the created markets. A broker who is bullish on a created market cash like the dollar can all the while short monetary standards from the developing business sectors. This is on the grounds that a more grounded dollar will in general influence wares like platinum and gold that are found in developing business sectors like South Africa.

In triangle Trade, a dealer abuses the open doors that outcome from an evaluating inconsistency among three monetary standards. With this, a dealer trades the principal money with the second, the second for a third, and the third for the underlying. The three basic sets utilized in this type of Trade are the EUR/GBP, GBP/USD, and the EUR/USD. Recall that while it is fundamental to think about Trade, it isn't allowed to Trade here at OctaFX, you can get familiar with this restriction here.

Last Thoughts

Hedging is a decent method to restrict misfortunes in the monetary market. This is on the grounds that a merchant who opens one un-supported Trade is constantly presented to the drawback chances. All things considered, Hedging requires a great deal of training to consummate. A demo account from OctaFX can assist you with improving your Hedging aptitudes.

0 Comments

Post a Comment